Deductible Progress Calculator

Understand Your Deductible Progress

This calculator shows how your copay card payments affect your deductible progress. Many insurers don't count manufacturer assistance toward your deductible, so you might be paying less out-of-pocket now but still far from full coverage.

When you’re managing a chronic condition like multiple sclerosis, rheumatoid arthritis, or Crohn’s disease, your medication isn’t just a pill-it’s your lifeline. But for many people, that lifeline comes with a price tag that can hit $10,000 a month. That’s where copay cards come in. These cards, offered by drug manufacturers, promise to cut your out-of-pocket costs to just a few dollars per prescription. Sounds like a miracle, right? But here’s the catch: what you don’t know can cost you everything.

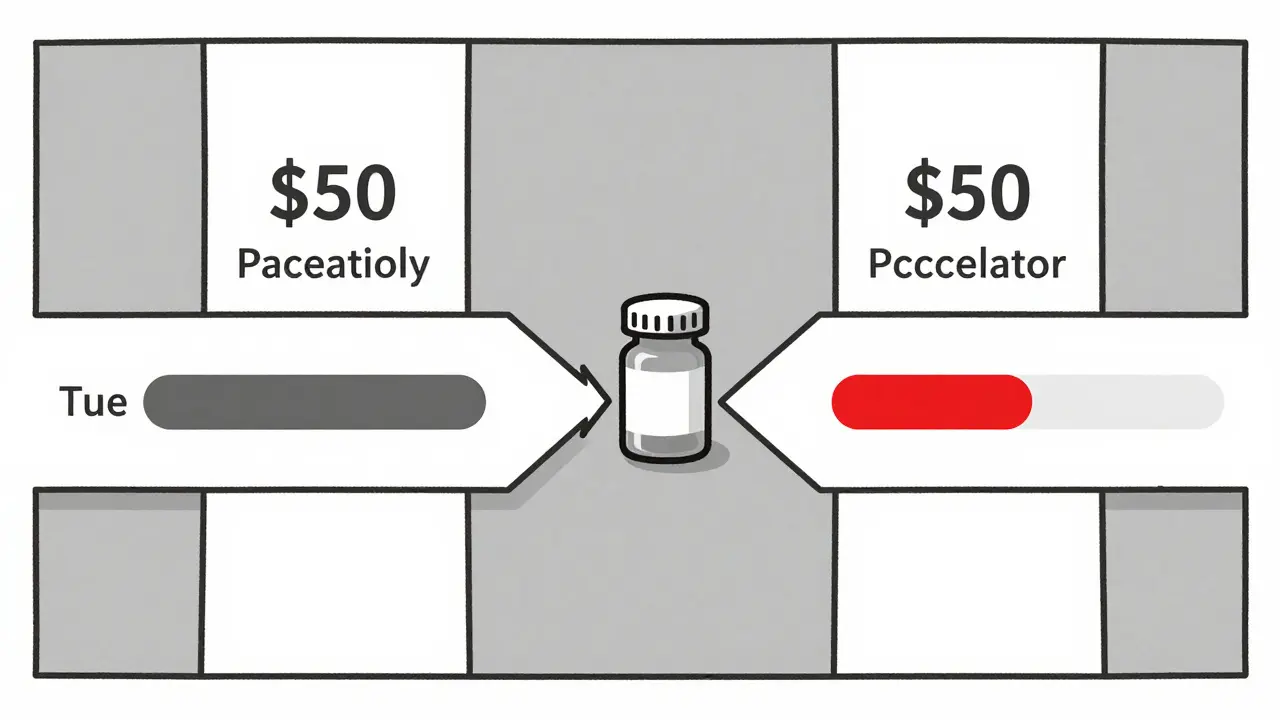

For years, copay cards worked exactly how patients expected. If your insurance required a $700 copay for a monthly drug, and the card covered $650, you paid $50. That $650 didn’t just vanish-it counted toward your deductible and out-of-pocket maximum. So every month, you got closer to the point where your insurance would cover 100% of the cost. That’s how it was supposed to work. But since 2016, insurers have quietly changed the rules.

How Copay Cards Used to Work

Before 2016, copay cards were straightforward. A patient with a $5,000 deductible and a $1,200 monthly drug would pay $100 thanks to the card. That $1,100 from the manufacturer? It counted toward their deductible. After four months, they’d hit $4,400 toward their $5,000 deductible. By July, they’d be covered fully. No surprises. No panic.

According to a 2023 NIH study (PMC10486291), 93% of patients using these cards said they made a real difference. For someone on biologic drugs for autoimmune diseases, that kind of savings meant sticking with treatment instead of skipping doses or quitting entirely. In fact, 68% of patients reported better adherence because of the cards. That’s not just convenience-it’s survival.

The Hidden Trap: Accumulator Programs

Now, 56% of commercial insurance plans have switched to something called a copay accumulator program. Here’s how it works: the manufacturer still pays your copay. But instead of counting toward your deductible, that money disappears from your account. It’s like your insurance says, “We’ll let you pay $50 this month, but we’re not going to count that $1,150 toward your $5,000 deductible.”

What happens next? You keep paying $50 every month. You think you’re getting closer to full coverage. But after a year, you’ve paid $600 out of pocket… and your deductible is still at $0. When your copay card runs out-usually after $15,000 to $25,000 in total assistance-you’re suddenly faced with the full $5,000 deductible. And if your drug costs $1,200 a month? You’ll need to pay $5,000 before your insurance kicks in again. That’s $4,400 in unexpected costs, all at once.

One patient on the National MS Society forum shared: “My $7,500 monthly medication became $10 after using the card for two years. Then the card expired. I didn’t realize my deductible was still $7,000. I had to stop treatment for three months.”

This isn’t rare. A 2021 study published in the Journal of the American Medical Association found that patients under accumulator programs were 23.4% more likely to stop taking their medication. That’s not just financial stress-it’s a health crisis.

Copay Maximizers: The Silent Killer

Some insurers don’t even stop at accumulators. They use copay maximizers. These programs set your copay to exactly match the maximum amount the card can cover. So if your drug costs $1,200 and the card covers up to $1,200, you pay $0. Sounds great, right?

Except now, you’re not paying anything toward your deductible. Ever. Your insurance sees you as having zero out-of-pocket spending. So when the card runs out, you’re staring at your full deductible-$5,000, $8,000, even $10,000-without having paid a dime toward it. This is worse than accumulators because it doesn’t just delay coverage-it resets your progress to zero.

According to Optum Business Insights (2024), maximizer programs increase total annual drug spending for insurers by 18.7% compared to accumulators. Why? Because patients end up paying more out of pocket later, and insurers end up covering more of the full cost. But you’re the one who pays the price-in pain, in stress, and in treatment gaps.

Who Gets Left Out?

Copay cards don’t help everyone. They’re illegal for Medicare and Medicaid patients because of federal anti-kickback laws. That means if you’re on government insurance, you’re on your own. No cards. No help. And if you’re uninsured? Forget it. These programs only exist for people with private insurance.

That’s a huge gap. More than 15 million Americans rely on specialty medications. And nearly 80% of those drugs now come with copay assistance. But if you’re on Medicare, you’re excluded from this safety net entirely. There’s no legal workaround. No alternative. Just silence.

How to Use Copay Cards Safely

You can’t avoid copay cards if you need them. But you can protect yourself. Here’s how:

- Ask your pharmacist before you use the card: “Does my insurance plan have an accumulator or maximizer program?” Don’t assume they’ll tell you. Ask directly.

- Check your plan documents. Look for terms like “copay accumulator,” “copay maximizer,” or “manufacturer assistance does not count toward deductible.” If you can’t find it, call your insurer and ask.

- Know your deductible. If you’re paying $50 a month and think you’re getting closer to coverage, you might be wrong. Ask your insurer: “How much of my deductible have I actually met this year?”

- Track your card’s value. Most cards have annual limits-$10,000, $20,000, sometimes $25,000. When you’ve used 80% of it, start preparing. That’s your warning sign.

- Plan ahead. Talk to your doctor or specialty pharmacy. Ask: “What happens when this card runs out?” They may have access to patient assistance programs, grants, or manufacturer support that kicks in after the card expires.

Specialty pharmacies are now required to document whether a patient is affected by an accumulator program. But not all do it right. A 2024 report from the Specialty Pharmacy Certification Board found that 18.3% of pharmacists still skip this step. Don’t rely on them. Be your own advocate.

What’s Changing in 2026?

Good news: change is coming. On January 1, 2026, a new federal rule takes effect. Insurers must now clearly disclose whether they use accumulator or maximizer programs during enrollment. They also have to send you a monthly statement showing your true progress toward your deductible-even if manufacturer payments don’t count.

That’s huge. For the first time, patients will know exactly where they stand. No more surprises. No more hidden traps. And in April 2024, CVS Caremark rolled out transparency dashboards for their members, showing real-time deductible progress. It’s not perfect-but it’s a start.

Meanwhile, Congress is weighing the Copay Accumulator Moratorium Act (H.R. 3959), which would ban these programs for three years while experts study their impact. With 72 bipartisan co-sponsors, it has real momentum. But drug companies spent $28.7 million lobbying against it in early 2024. This isn’t just about money-it’s about who gets to decide your health.

What You Can Do Now

Don’t wait for a rule change. Don’t hope for a miracle. Take action today:

- Call your insurance company. Ask for a written explanation of their copay policy.

- Request a copy of your plan’s Summary of Benefits and Coverage (SBC). Look for the section on “manufacturer assistance.”

- If you’re on a long-term therapy, set a reminder for 60 days before your copay card expires. Start researching alternatives.

- Reach out to patient advocacy groups. The Spondylitis Association, Multiple Sclerosis Foundation, and others offer grants, co-pay relief, and direct financial aid.

Medication shouldn’t be a gamble. Your health shouldn’t depend on a hidden clause in a contract you never read. Copay cards were meant to help you stay alive. Don’t let them become a trap.

Are copay cards free money?

No. Copay cards aren’t free-they’re a financial tool used by drug manufacturers to help you pay for your prescription. The manufacturer covers part of your cost, but this money doesn’t always count toward your deductible. If your insurance uses an accumulator or maximizer program, the card’s value won’t reduce what you owe in the long run.

Can I use a copay card with Medicare or Medicaid?

No. Federal law prohibits pharmaceutical companies from offering copay assistance to patients enrolled in Medicare, Medicaid, or other government health programs. This is due to anti-kickback statutes meant to prevent financial incentives that could influence prescribing. If you’re on Medicare or Medicaid, you’ll need to explore other options like patient assistance programs or state-based aid.

What’s the difference between an accumulator and a maximizer program?

An accumulator program takes the manufacturer’s payment and doesn’t count it toward your deductible or out-of-pocket maximum. A maximizer program goes further: it sets your copay to match the maximum amount the card can cover, so you pay $0-but you also make zero progress toward your deductible. Both prevent you from reaching full insurance coverage, but maximizers are more deceptive because they make it look like you’re not paying anything.

How do I know if my plan has an accumulator program?

Check your insurance plan’s Summary of Benefits and Coverage (SBC). Look for phrases like “manufacturer copay assistance does not count toward deductible” or “out-of-pocket costs are based on patient payments only.” Call your insurer and ask directly: “Do you use copay accumulator or maximizer programs for specialty medications?” If they hesitate or give vague answers, assume they do.

What should I do when my copay card runs out?

Start planning at least 60 days before your card expires. Contact your specialty pharmacy-they may have access to manufacturer support programs that kick in after the card ends. Reach out to nonprofit patient advocacy groups that offer grants or co-pay assistance. Talk to your doctor about lower-cost alternatives or generic options if available. Never stop medication abruptly-work with your care team to avoid dangerous treatment gaps.