More than 9 out of 10 prescriptions in the U.S. are filled with generic drugs. They’re cheaper, widely available, and trusted - or at least they were. Today, hospitals are scrambling. Pharmacists are calling patients to explain why their usual medication isn’t in stock. People with chronic conditions are paying 40 times more just to get the same pill they’ve taken for years. And it’s not random. This is a system breaking down - not because of bad luck, but because of how the market is built.

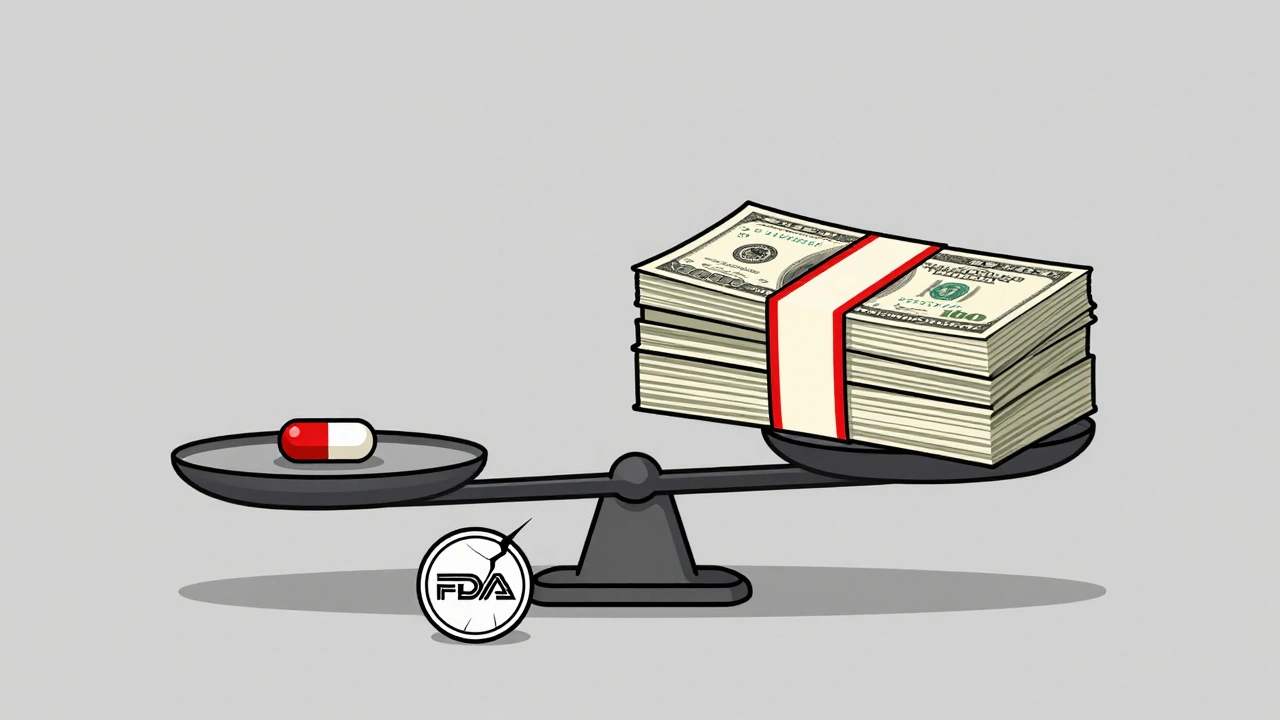

The Price That Broke the System

Generic drugs cost less because they don’t need to pay for research, marketing, or patents. That sounds fair. But in practice, it means manufacturers compete on price alone - down to fractions of a cent per tablet. Group purchasing organizations (GPOs) and pharmacy benefit managers (PBMs) award contracts to the lowest bidder, even if that bid is below the cost of production. One manufacturer told investigators they were selling a common antibiotic for $0.003 per tablet. The raw ingredients alone cost $0.002. That leaves nothing for labor, quality control, packaging, or shipping.When margins shrink this thin, there’s no money left to invest in better equipment, trained staff, or reliable supply chains. So companies cut corners. They delay maintenance. They skip upgrades. They outsource more to cheaper countries - even when those suppliers have poor inspection records. The result? A race to the bottom that’s leaving patients behind.

Where Your Medicine Comes From

You might think your generic pills are made in America. They’re not. As of 2023, only 14% of the active ingredients in U.S. generic drugs are produced domestically. Over half come from India. Another large chunk comes from China. That’s not just a number - it’s a vulnerability.In 2020, when India halted exports of acetaminophen and other key drugs during the pandemic, U.S. hospitals ran out within weeks. Acetaminophen isn’t some rare specialty drug - it’s in painkillers, cold meds, and fever reducers used by millions. When the source shuts down, the whole supply chain freezes.

Even worse, manufacturing isn’t localized. One company might make the active ingredient in India, ship it to a facility in Mexico to mix with fillers, send it to China for coating, then package it in Poland. Each stop adds risk. A single delay, inspection failure, or quality issue at any point can knock a drug off shelves nationwide.

Quality Problems You Can’t See

The FDA inspects foreign facilities less often than domestic ones - and when they do, they find serious issues. In 2022, the FDA pulled Intas Pharmaceuticals’ cancer drug cisplatin off the market after finding “enormous and systematic quality problems.” The company had falsified data, skipped tests, and used unapproved ingredients. This wasn’t a one-time mistake. It was routine.Studies show generic drugs made overseas have 54% more serious adverse events - including hospitalizations and deaths - than those made in the U.S. That doesn’t mean every foreign-made drug is dangerous. But it does mean the system isn’t catching problems before they reach patients.

Domestic manufacturers follow stricter documentation rules. U.S. plants keep 95%+ accurate batch records. Some foreign facilities hover around 78%. That gap isn’t just paperwork - it’s safety. If a batch goes bad and no one knows why, you can’t recall it properly. You can’t fix it. You just wait for patients to get sick.

Why No One Fixes This

The FDA can’t force companies to make more drugs. Their only tools are inspections, warnings, and public notices. When a shortage happens, they call manufacturers and ask nicely to produce more. That’s it.Meanwhile, the government spends billions on branded drugs through Medicare and Medicaid - but generic drugs are treated like commodities. Hospitals are pressured to buy the cheapest option, even if it’s from a supplier with a history of violations. There’s no reward for quality. No penalty for unreliability. Just price.

Some hospitals are trying to fix this themselves. In 2023, 68% of health systems started cutting out middlemen and buying directly from manufacturers. That gives them more control over quality and supply. But it’s not scalable. Smaller clinics and pharmacies can’t negotiate those deals.

The Numbers Don’t Lie

In October 2023, the FDA recorded 278 active drug shortages - the highest number since tracking began in 2011. Two-thirds of them involved generic drugs. That’s not a spike. It’s a trend.Since 2010, the number of U.S.-based generic manufacturers has dropped from 35% of total API production to just 14%. Thirty-seven percent of domestic manufacturers have shut down or operate at idle capacity. The top five companies now control nearly half the market. That’s not competition. That’s consolidation under pressure.

And it’s getting worse. Experts predict the number of U.S. generic manufacturers will fall from 127 in 2022 to 89 by 2027. That means fewer backups when one company fails. Fewer options when a facility shuts down. Fewer chances to recover.

What’s Being Done - and Why It’s Not Enough

There are efforts to fix this. The FDA’s Emerging Technology Program has approved 12 new continuous manufacturing facilities since 2019. These use real-time monitoring and automated controls - making production faster, safer, and more reliable. But they account for less than 3% of total generic output.Congress introduced bills in 2023 to give tax breaks for domestic API production and create strategic stockpiles of critical drugs. That sounds good. But without changing how drugs are priced, these fixes won’t stick. You can’t build a factory if no one can afford to run it.

The CREATES Act of 2019 tried to stop branded drugmakers from blocking generic competition. That helped with new market entries - but it didn’t solve the core problem: the market rewards the cheapest, not the most reliable.

What This Means for You

If you take a generic drug daily - for blood pressure, thyroid issues, diabetes, or depression - you’re at risk. When shortages hit, you might get switched to a different brand. That’s not harmless. Even small differences in formulation can change how your body absorbs the drug. One patient saw their monthly cost jump from $10 to $450 when their generic ran out.Pharmacists are forced to make impossible choices: give you a different generic, wait weeks for a restock, or push you to a more expensive brand. Many patients don’t even know they’re being switched. They just notice their medication doesn’t work the same way.

This isn’t a future threat. It’s happening now. In 2023, nurses reported switching antibiotics for 17 different infections due to shortages. Patients on levothyroxine had to be closely monitored after switching brands. Cancer patients waited for cisplatin to become available again - sometimes for months.

Generic drugs aren’t going away. They’re too important. But the system that makes them is broken. And until we stop treating medicine like a commodity - and start treating it like a public good - shortages will keep getting worse.

Yasmine Hajar

I had to switch my blood pressure med last month and my pharmacist didn’t even tell me until I asked why the pill looked different. Now I’m dizzy half the day. This isn’t just a supply issue - it’s a betrayal.

They treat our lives like inventory.

Someone needs to burn this system down.

Karl Barrett

The structural incentives are misaligned at every level: PBMs extract rent, GPOs optimize for lowest bid, and the FDA lacks enforcement teeth. We’ve commodified pharmacology - treating bioequivalence as a binary checkbox rather than a dynamic physiological interface. The result? A fragile, globally distributed supply chain with zero redundancy, optimized for profit margin, not patient resilience.

It’s not a crisis of scarcity - it’s a crisis of valuation.

Jake Deeds

You know what’s funny? I used to think generics were just as good. Then I started reading the FDA warning letters. Turns out, some of these pills are made in factories where the floor is dirt and the inspectors get paid in chai tea.

And we wonder why people die from ‘unexplained’ side effects.

It’s not a conspiracy - it’s capitalism with a side of denial.

val kendra

My mom’s levothyroxine went out of stock for 11 weeks. She was crashing. We had to call 7 pharmacies. One had it but it was from a different country - she had to get her levels checked every week. No one warned her. No one cared.

Stop treating medicine like toilet paper. It’s not a commodity. It’s survival.

And yes, I’m angry. You should be too.

Isabelle Bujold

It’s not just about manufacturing - it’s about the entire economic architecture that disincentivizes quality. When the lowest bidder wins, innovation dies. When profit margins are measured in fractions of a cent, safety becomes a luxury. We’ve outsourced not just production but responsibility. And now we’re paying the price in hospitalizations, delayed treatments, and lives lost because someone chose a cheaper supplier in a country with lax oversight. The FDA can’t inspect every facility. Congress won’t fund it. And patients? We’re the collateral damage in a market that values cost over care.

George Graham

I work in a rural clinic. We don’t have the clout to buy direct. We get whatever’s cheapest and available. Last week, we had to give a diabetic patient a different metformin. She said her feet felt numb again. We didn’t know why. We still don’t.

It’s not that people don’t care - it’s that the system makes caring impossible.

John Filby

Wait so you’re telling me the same pill I’ve taken for 8 years suddenly costs $450 because the factory in India had a power outage? 😳

That’s insane. And no one’s doing anything? I’m so mad right now.

Someone needs to start a petition or something. Like, right now.

Elizabeth Crutchfield

i just got my thyroid med and it looks different again. i dont even know what to do anymore. i just take it and hope i dont die. this is so fking scary

Ben Choy

My brother’s in the UK and he’s had the same issue - but worse. They ration some generics now. I never thought I’d see a day when your meds are treated like water during a drought.

It’s not just an American problem. It’s a global failure.

Emmanuel Peter

So let me get this straight - we let China and India make 86% of our medicine, then wonder why people die? That’s not negligence. That’s treason.

Who’s the CEO of the company that owns the plant that made that cisplatin? I’m looking them up right now.

Ashley Elliott

For everyone saying ‘just buy the brand name’ - that’s not an option for most people. I’m a single mom on Medicaid. I can’t afford $450 pills. And I shouldn’t have to choose between food and my blood pressure med.

We need systemic change - not just ‘support local’ slogans.

But I’m glad someone’s finally talking about this.

Chad Handy

It’s all connected. The same people who cut corners on drug manufacturing are the ones who cut funding for public health, defunded the FDA, and lobbied against price controls. They don’t care if you die - they care if their quarterly earnings look good.

And you know what? They’re winning.

Every time you take a pill you didn’t know the origin of, you’re complicit.

Wake up.

Augusta Barlow

Did you know the FDA’s inspection backlog is over 1,000 facilities? And that the same companies that got flagged for falsifying data are still making drugs? And that the government gave them tax breaks last year? This isn’t a ‘crisis’ - it’s a coordinated cover-up. The whole thing’s a psyop to push people toward biologics and private healthcare. You think this is about price? No. It’s about control. They want you dependent on expensive, patented drugs. The generics are being sabotaged on purpose. I’ve seen the documents. They’re not letting you see them.